As briefly reported here, on October 23, 2020, the Patented Medicine Prices Review Board (PMPRB) published the final version of its Guidelines. These Guidelines operationalize the amendments to the Patented Medicines Regulations scheduled to come into force on January 1, 2021 (see our article here). The Guidelines state they are not binding and may be revisited by the PMPRB “in light of experience and changing circumstances”.

This article provides a brief summary of the final framework for the price review process and highlights changes relative to the June 2020 draft Guidelines (reported in detail here). See also the PMPRB’s October NEWSletter for the PMPRB’s overview of the final changes.

Final framework

(i) Categorizing patented medicines

Patented medicines will be categorized as one of:

- Grandfathered medicines - all dosage forms and strengths of medicines for which the patentee was assigned a Drug Identification Number (DIN) prior to August 21, 2019, regardless of whether those dosage forms and strengths have been approved for new indications (without a DIN change) after August 21, 2019.

- Line Extensions - new dosage forms and strengths of Grandfathered medicines to which a DIN was assigned on or after August 21, 2019.

- Gap medicines - medicines for which a DIN was assigned on or after August 21, 2019 and first sold in Canada prior to January 1, 2021.

- New medicines - all other dosage forms and strengths of medicines that do not fall into one of the above categories.

The same price review factors are considered for all patented medicines, except that for New medicines, (i) the pharmacoeconomic value in Canada of the medicine; (ii) the size of the market for the medicine in Canada; and (iii) the gross domestic product in Canada and the gross domestic product per capita in Canada are also considered.

(ii) Price review process for new medicines

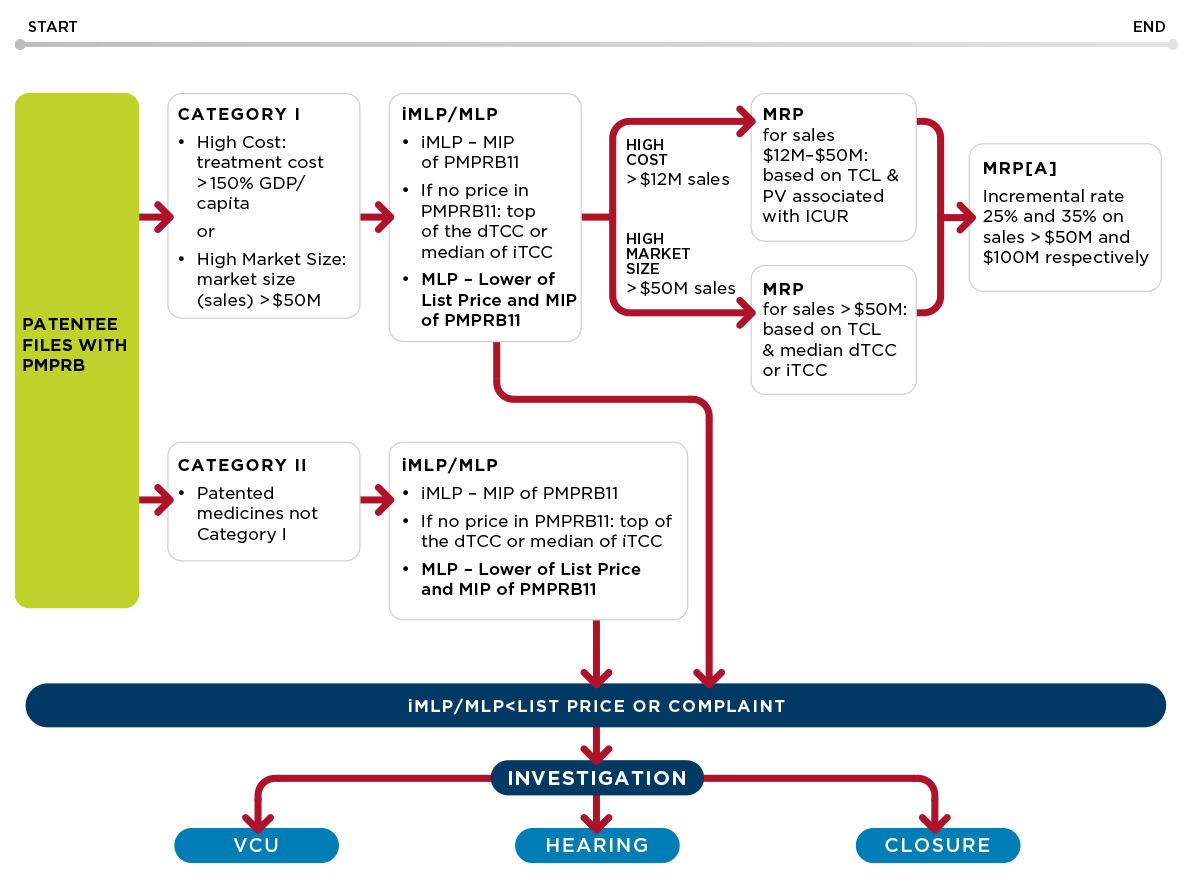

The overall price review process for New medicines is described in this schematic (and remains largely unchanged from the June 2020 draft):

The Guidelines outline a two-step process for the price review of new medicines.

In the first step, an interim maximum list price (iMLP) will be set based on the median international publicly available ex-factory list price (MIP) for the PMPRB11 countries. The list price cannot exceed the iMLP during the interim period. However, if the patentee has not filed PMPRB11 pricing after two reporting periods, the iMLP will be set by the top of the domestic therapeutic class comparison test (dTCC) (see Appendix A) and if no domestic therapeutic class comparators are available, the MLP may be set by the median of the international therapeutic class comparison (iTCC).

In the second step, following the defined interim period, the iMLP will be replaced by the maximum list price (MLP). The MLP will be the lower of the list price and the MIP. If PMPRB11 prices are not filed by the end of the interim period, the MLP is set by the lower of the list price and the top of the dTCC and as above, if no domestic therapeutic class comparators are available, the MLP may be set by the median of the iTCC.

Prices for medicines classified as Category I will be considered in light of an additional pricing factor, but only in the context of an investigation (see discussion below) – the maximum rebated price ceiling (MRP) that may be further adjusted based on the size of the market (MRP[Adjusted] = MRP[A]). A medicine will be classified as Category I if either 12 months of treatment costs greater than 150% of GDP per capita or if the estimated or actual market size (sales) exceeds $50M annually. All other New medicines, and biosimilars and generic medicines, will be classified as Category II.

The MRP takes into account therapeutic criteria level (TCL) (levels I–IV and the scientific review process as described in Appendix E), pharmacoeconomic value and market size of the medicine (see Appendix C). The calculation of MRP[A] is described in Appendix D.

(iii) Price review process for grandfathered medicines, line extensions, and gap medicines

Grandfathered and Line Extension medicines will be subject to an MLP, but not an iMLP. The MLP for such medicines will be the lower of (i) the highest international price (HIP) for the PMPRB11 countries, or (ii) the medicine’s ceiling (e.g., the non-excessive average price (NEAP)) under the February 2017 version of the Guidelines. Patentees must comply with the MLP within one reporting period of the MLP being set for Line Extension medicines and within two reporting periods for Grandfathered or Gap medicines.

Gap medicines will be subject to an iMLP assessed in the same manner as an iMLP for New medicines. The MLP for Gap medicines will be the lower of (i) the MIP for the PMPRB11; or (ii) the medicine’s ceiling (e.g., the NEAP or the maximum average potential price (MAPP)) under the February 2017 Guidelines.

(iv) Reassessment

The Guidelines also provide a number of circumstances in which categories (i.e., whether a medicine falls into Category I or Category II) or price ceilings may be reassessed. For example, for New medicines, a reassessment may be conducted if the medicine is approved for a new indication or its cost-utility analysis is updated. Also by way of example, a Category II medicine receiving a new indication may be re-categorized to Category I if it meets the Category I screening criteria. As a further example, for Grandfathered medicines and their Line Extensions, if the prevailing HIP is lower than the MLP for two consecutive reporting periods, the MLP will be reset by the prevailing HIP.

Changes relative to June 2020 draft guidelines

PMPRB will only consider Maximum Rebated Price if an investigation is triggered

Under the June 2020 draft Guidelines, patentees of Category I medicines were required to ensure that the medicine’s average transaction price in Canada is no higher than the MRP ceiling, failing which the price may be subject to additional review or investigation by the Staff.

Pursuant to the final Guidelines, investigations into Category I medicines “will only be triggered by the patentee’s failure to comply with the iMLP or MLP”, although the Board may consider MRP or MRP[A] in the context of such an investigation.

In its October NEWSletter, the PMPRB attributed this change to the June 29, 2020 Federal Court decision invalidating subsection 3(4) of the Amendments (reported here), which would have expanded price calculation requirements to include information beyond the first point of sale including third party rebates. The Newsletter notes that the PMPRB may revisit this approach based on the outcome of the pending appeal of the decision.

Revisions to Maximum List Price

Pursuant to the June 2020 draft Guidelines, the MLP for New medicines was set as the MIP for the PMPRB11 countries where such prices were available, absent which the MLP was set by the top of the dTCC. In the final Guidelines, the MLP is set as the lower of the list price and the MIP, and absent international prices, the MLP is similarly set as the lower of the list price and the top of the dTCC.

The MLP for Grandfathered, Line Extension, and Gap medicines remains unchanged relative to the June 2020 draft Guidelines.

Revisions to Maximum Rebated Price

Various minor changes were also made to the MRP calculation. Most significantly, the Pharmacoeconomic Value Threshold (PVT) used to calculate the MRP and MRP[A] of Category I medicines was reduced from $150K per quality-adjusted life years (QALY) to $100K per QALY for Level IV medicines (i.e., medicines which provide no or slight improvement relative to other medicines sold in Canada).

In addition, the MRP for medicines with an actual market size exceeding $50M was previously set as the median of the dTCC taking into account the applicable floor; in the final Guidelines the MRP is the lower of the MLP and the median of the dTCC.

Reassessment for Grandfathered and Line Extension medicines limited to HIP

Under the June 2020 draft Guidelines, the MLP for Grandfathered and Line Extension medicines would be reset: (i) by the prevailing HIP if, in two consecutive subsequent periods, the prevailing HIP was lower than the MLP; or (ii) by the prevailing MIP if, in two consecutive subsequent periods, the prevailing MIP was lower than the MLP by more than 10%. The final Guidelines drop the latter reassessment, such that only the former applies.

MRP may be decreased OR increased based on market

The June 2020 draft Guidelines would require a decrease to the MRP in response to increased sales, but had no corresponding provision to increase the MRP to account for decreased sales. Under the final Guidelines, the MRP may be increased back to the MLP if sales fall to $12 million or less for High Cost medicines, or to $50 million or less for High Market Size medicines.

Vaccines to be subject to the same complaints-based investigation criteria as patented biosimilars and generics

New patented vaccines will only be subject to a price review and investigation if a complaint is received by the PMPRB.

Guidelines will be subject to parliamentary scrutiny

On October 26, the House of Commons Standing Committee on Health announced that it would undertake a study of the final Guidelines. The Committee has invited stakeholders and individuals to submit requests to appear before the Committee and written submissions to the Clerk of the Committee no later than November 6, 2020.

Should you have any questions, please do not hesitate to contact a member of the Life Sciences Regulatory & Compliance Group.

The preceding is intended as a timely update on Canadian intellectual property and technology law. The content is informational only and does not constitute legal or professional advice. To obtain such advice, please communicate with our offices directly.

Related Publications & Articles

-

Finalized PMPRB Guidelines published

On June 30, 2025, the Patented Medicine Prices Review Board (PMPRB) published its new Guidelines for PMPRB Staff, which will come into force on January 1, 2026.Read More -

2025 mid-year highlights in Canadian life sciences IP and regulatory law

In the first half of 2025, the Rx IP Update team reported on a number of developments in Canadian life sciences IP and regulatory law. Below are our top stories.Read More -

Federal Court of Appeal confirms generic not required to address patent submitted before ANDS filing but listed after

On August 8, 2025, the Federal Court of Appeal (FCA) determined that the Minister of Health’s decision to list Canadian Patent No. 2,970,315 on the Patent Register eight days after it was submitted to...Read More